- Contributions to SDGs

-

Seven Bank will work on this Materiality through the development of a safe and secure social platform by offering a settlement infrastructure and contribute to the achievement of Sustainable Development Goals (SDGs) 9, 11 and 16.

Changes in the society and associated issues as seen by Seven Bank

In recent years, the financial environment in Japan has changed significantly, and even as various digital settlements enabled by technological innovations expanded, there has been rising concerns over increasingly crafty and sophisticated financial crimes and security. In addition, people feel anxious over the decline in the number of counters and ATMs of financial institutions as well as settlements (cash shortage) during frequently occurring natural disasters. It is important for Seven Bank to offer an infallible security system and play the role of social infrastructure that can be used with ease of mind even in emergencies such as during a natural disaster.

Changes in Seven Bank and its approach to the issue

Seven Bank will leverage the knowledge it has cultivated since its inception in various new settlement services and proactively adopt technology innovation to offer a secure and efficient settlement infrastructure. Moreover, it will develop a safe and secure financial platform conforming to the changes of time in cooperation with stakeholders led by financial institutions.

ATMs for greater security and peace of mind

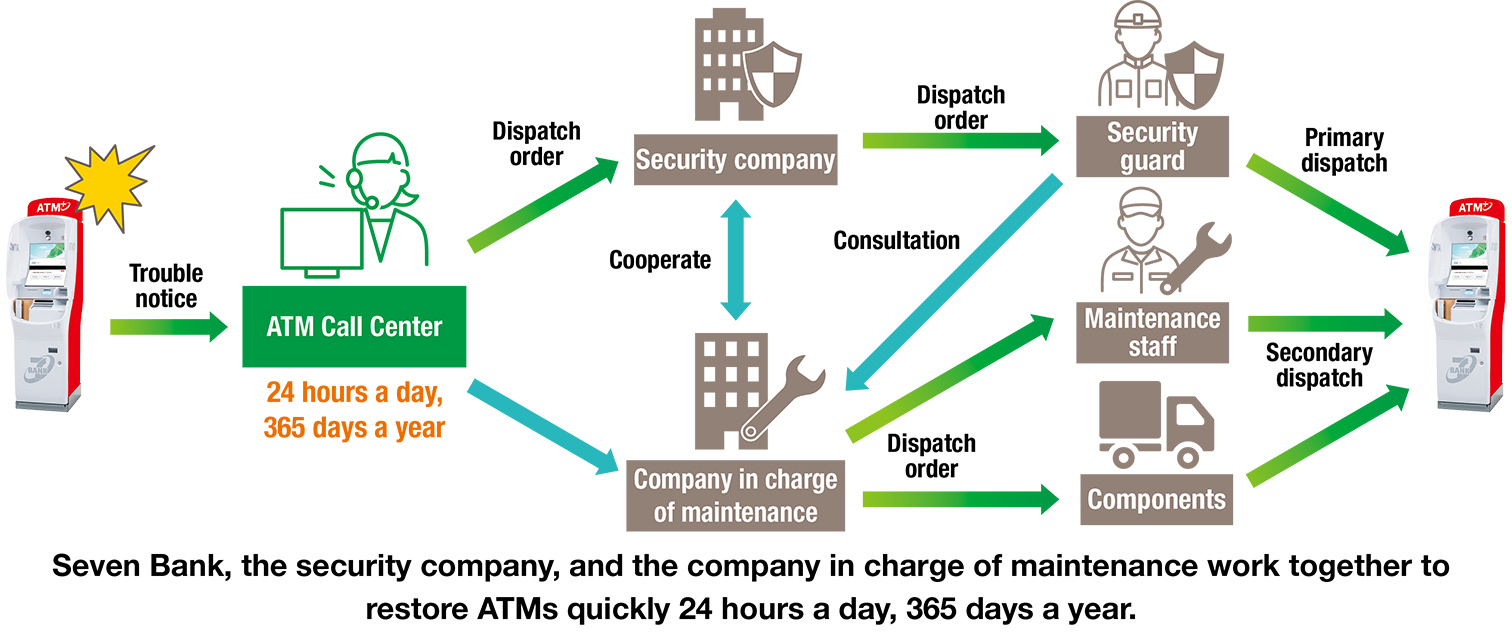

Stable operation of ATMs

Seven Bank’s ATMs operate 24 hours a day, 365 days a year, in principle. Providing an environment that anyone can safely use requires collaboration with partner companies with highly specialized skills that conduct from response to ATM failures to providing security for machines and guarded transport. Depending on locations where ATMs are installed, some ATMs are highly likely to run out of cash due to more frequent cash withdrawal while other ones would be readily full up with cash deposited. By analyzing such usage pattern and operational situation of each ATM in cooperation with security companies, and setting timing of replenishing cash according to the usage pattern, the frequency and duration of stoppages have been minimized.

- Normal Situations

-

- ■ System Base Redundancy

- The relay system that forms the backbone of the network and ATM support centers and call centers that are our points of contact with customers have been set up in two locations in eastern and western Japan to prevent interruption of transactions due to a disaster or other reason. The relay system has been structured to maintain normal operations, without a moment of downtime.

-

- ■ Security Measures

- Seven Bank and its partner financial institutions are connected by a network of dedicated lines. In addition, data is encrypted according to the type of transaction, with automatic detection of unauthorized access.

- Emergencies

- ATM Call Centers also monitor our ATMs 24 hours a day, 365 days a year, and remotely recover out-of-service ATMs. In case of ATM failures during use by customers, a cash card, etc. is remotely returned in order not to make the customers wait. When a cash card, etc. cannot be returned remotely during the failure, ATM Call Centers promptly call for dispatch of security companies, and appropriately respond to such customers in trouble, aiming to restore the ATM quickly in cooperation with companies in charge of maintenance. Through this collaboration with partner companies, Seven Bank’s ATMs are able to achieve a 99.98% operating rate. Even when a blackout occurs during a transaction, it is possible to complete a transaction uninterrupted. Seven Bank ATMs embed Uninterruptible Power Supply (UPS) batteries. Even after the ATM is suspended, the ATM user can still inquire using the intercom and security functions are maintained, just in case a blackout occurs.

ATM Functions That Anyone Can Use with Peace of Mind

Our aim is for Seven Bank ATMs to be capable of being used by anyone at any time, easily and with peace of mind.

- Measures to protect privacy

- Seven Bank ATMs are equipped with “rear-view mirrors” that allow users to see what is behind them, and the screens are coated with a “special side-view prevention film” that stops people standing nearby from seeing the displays when users input the PIN and monetary amount. In addition, the ATM notifies users if they forget to take their card when they start to walk away, in an effort to make transactions safe and give people peace of mind.

”Fourth-Generation ATMs” to Address Changes of the Times

New “fourth-generation ATMs” address changes in society and customer needs with new technologies like facial recognition and AI

We began installing fourth-generation ATMs in September 2019 to address changes of the times, including lifesty le changes, the use of smartphones, and the diversification of payment methods. With personal authentication using facial recognition and the capability of reading QR codes,* fourth-generation ATMs are opening a new world of possibilities for new services and styles of ATM use, as a multifunction platform that is not limited to conventional ATM transactions that mainly involve withdrawing and depositing cash. We are also aiming for greater operating efficiency by using AI for precisely forecasting demands for cash and predicting various types of parts breakdowns.

- ※QR code is a registered trademark of DENSO WAVE INCORPORATED

Contributing to the Safety and Security of Society as a Whole

Continuous, effective measures against increasingly ingenious financial crime are essential to maintaining a safe, secure settlement environment. Because Seven Bank provides financial services through transactions carried out via ATMs and the Internet without face-to-face interaction, we are keenly aware of the importance of security and damage prevention and are taking various measures to ensure that customers can make transactions with peace of mind.

■ Cybersecurity Measures at ATMs

We are introducing features in our ATMs to prevent people from being able to see another person’s touch pad for inputting PINs and monetary amounts. When a customer makes a money transfer with one of our ATMs, an alert is shown on the screen or audio assistance is given to prevent fraudulent money transfers by reminding the user of potential crimes. In addition, our ATMs are equipped with devices that constantly operate to detect suspicious objects and irregular transactions, and to prevent the fraudulent capturing of card information (skimming). Moreover, to prevent financial crime from spreading, our ATMs are compatible with international-standard IC cards, and a system has been introduced to detect fraudulent ATM use.

■ Measures at Seven Bank Accounts

To prevent Seven Bank accounts from being used for crime, thorough legal checks are carried out when account openings are requested, to strengthen our measures against fraudulent accounts. In addition, we take the measures shown below to address crimes targeting Internet transactions after accounts are opened.

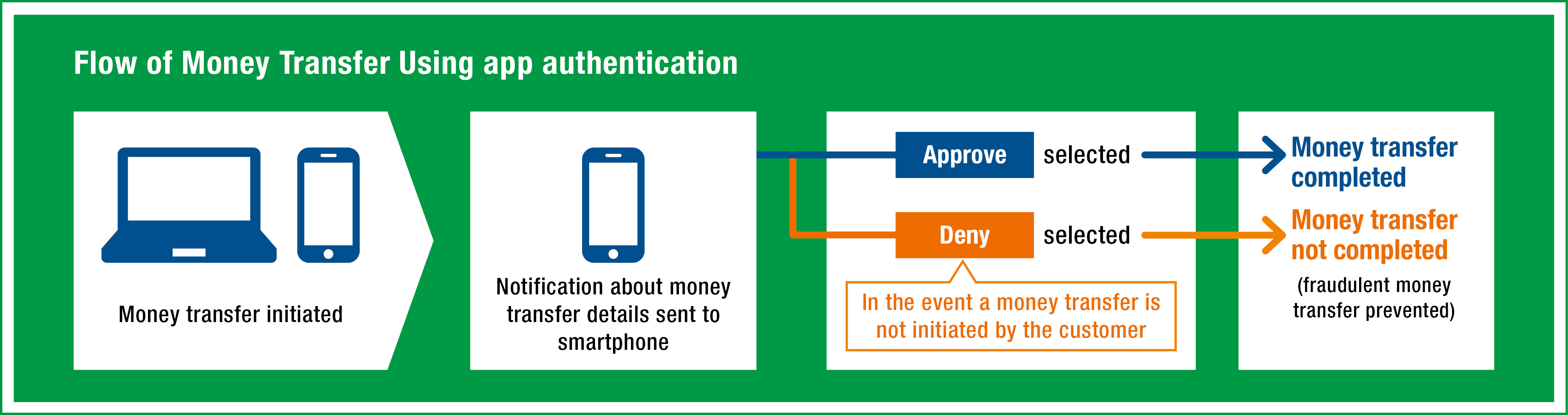

- For individual customers

- We have introduced app authentication*1 for Direct Banking Service. A specialist division also conducts multilayered monitoring of transactions and accesses as we strive to prevent damage from crimes. For use of the “My Seven Bank” or “Seven Bank International Money Transfer App” smartphone app, we have enhanced safety by introducing handset authentication※2in addition to passcode authentication.

- For corporate customers

- We have strengthened our security measures by introducing tools including One-Time Password※3and an approval procedure that requires more than one person, for customers’ greater peace of mind.

- ※1App authentication: An authentication method whereby customers take the steps to express their approval using the SEVEN BANK Money Transfer App or Seven Bank International Money Transfer App when they conduct transactions such as a money transfer via the Direct Banking Service. By this method, they can prevent unauthorized money transfers even in the event that their password is stolen by a third party.

- ※2Handset authentication: Advance registration of a smartphone to be used for logging in reduces the risk of fraudulent use by a third party

- ※3One-Time Password: A password that is effective only one time (a certain duration only) to reduce the risk of fraudulent use by a third party

Support for Financial Institutions' Measures to Counter Money Laundering

Measures are being sought daily to counter increasingly intricate types of financial crime. At Seven Bank, we are offering our expertise in preventing fraudulent accounts to Bank Business Factory Co., Ltd., which began undertaking outsourced operations for account transaction monitoring in 2018. This service uses transaction data provided by partner financial institutions and identifies and regularly reports on suspicious transactions. Financial crime countermeasures need to be constantly updated and enhanced, and meeting the needs of partner financial institutions in this area helps them provide safe and secure settlement service.

Disaster Support

Dispatch of Mobile ATM Vehicle

After the Great East Japan Earthquake in March 2011, we dispatched mobile ATM vehicles to regions where considerable time was required to resume ATM businesses.

From October 2015 to March 2016, we regularly dispatched mobile ATM vehicles to Katsurao Village, Fukushima Prefecture, which is designated as an evacuation zone due to the Fukushima Daiichi Nuclear Accident, to support the reconstruction of the region.

Collaboration with Partner Companies

Relations with Partner Financial Institutions

Since its founding, Seven Bank has provided ATM services that can be accessed “anytime, anywhere, by anyone, and with safety and security,” while providing various values to our partner financial institutions, etc. We have built strong relationships of trust by offering Seven Bank’s ATM network infrastructure, operations expertise and management know-how, by enhancing customer convenience and by helping reduce the operational and management burden of the ATMs of our partner financial institutions. We also take into consideration the challenges and needs of our partner financial institutions and continually evolve our unique added value to increase convenience by, among other means, supporting cards issued overseas by major international companies and offering various types of electronic money and new settlement services such as QR and bar-code settlement.

We also offer our expertise in preventing fraudulent accounts with our consolidated subsidiary Bank Business Factory Co., Ltd., thereby providing new support services as countermeasures to money laundering and back-office support on commission for financial institutions, striving to contribute to solving social issues in the finance industry as a whole.

Partner Companies: Relations with ATM Manufacturers

Seven Bank develops and manufactures its ATMs jointly with its manufacturing partners. To develop and manufacture our unique ATMs that are both simple and highly functional, we stand in our customers’ shoes and share yet-unmaterialized needs, following our commitment to achieve goals through repeated discussions with our partners from the conceptual stage.

Our ATMs are assembled in Japan by our partner companies, and Seven Bank’s officers and employees regularly pay unannounced observation visits to confirm security, operating efficiency, etc. In addition, sensors within ATMs carry out preventive maintenance at the first sign of a problem, and timely inspections are done as necessary, to stop outages from occurring. If ATM maintenance is required due to an unforeseen problem, we send a maintenance worker from our partner company’s affiliate to restore the ATM to service, thus minimizing downtime.

- Seven Bank’s Sustainability

- Top Message

- Sustainability Management

- ESG

- Environment

- Social

- Corporate Governance

- Materiality

- Formulating our materialities

- Materiality 1

- Materiality 2

- Materiality 3

- Materiality 4

- Materiality 5

- Social Contribution Activities

- For Future Generations

- Social Contribution Activities

- Other Corporate Information

- Investor Relations

- Company